Wait… Are you leaving the Money on the Table?

Acquiring a new customer can cost five times more than retaining an existing customer!

Let’s dive into the stats! Increasing customer retention by 5% can increase profits by 25-95% whereas the success rate of selling to a customer you already have is 60-70%, while the success rate of selling to a new customer is 5-20%. (source)

What does it mean to the company with a huge customer base- Like Telecom?

A leading B2B Telecom service provider was facing the challenge of continuous customer churn. They had more than 100K B2B customers and were adding more aggressively. The management realized that they were losing customers at an alarming rate, every month. With 100K customers on board and more coming in every month, this was a daunting challenge.

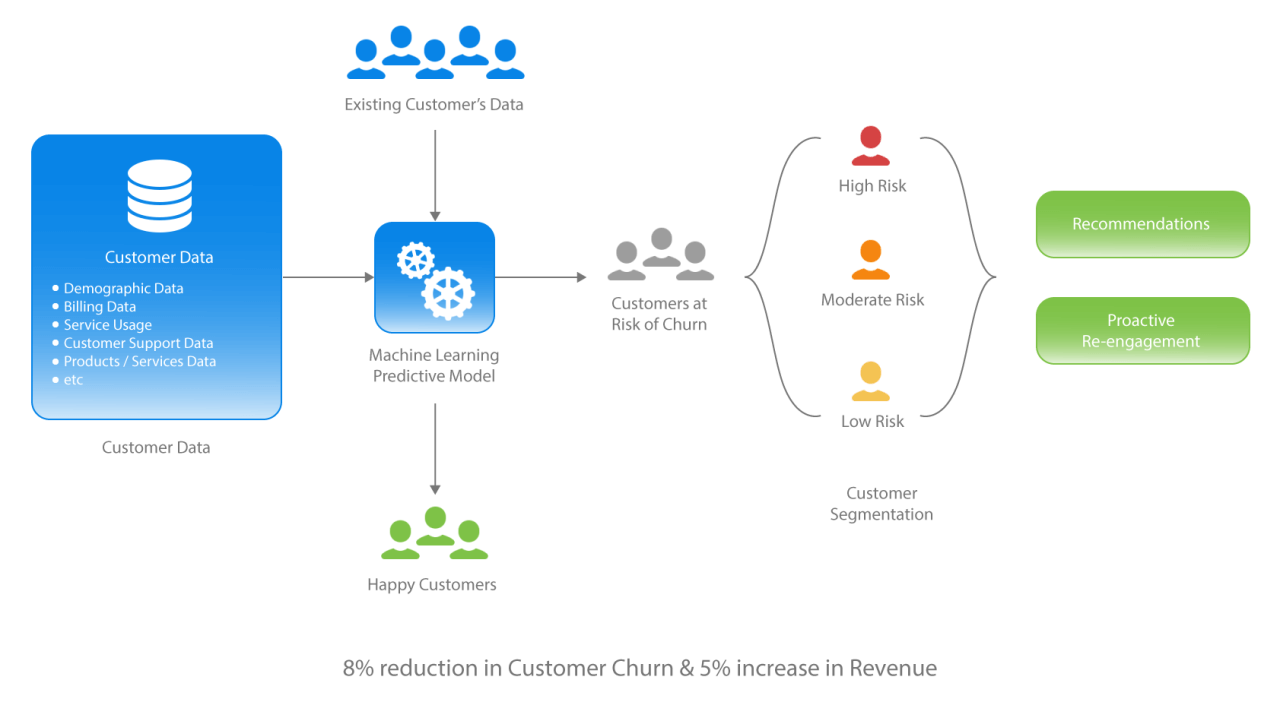

How could you even identify customers who could potentially leave? Theoretically, by analyzing and co-relating at the data generated by every customer (operations, call data, billing, communications, support) it is possible to manually identify such customers. But the sheer volume of data for all the customers, makes this task look impossible to do it manually.

This is a daunting challenge for anyone to crack; Enter Coreview’s Data Science team. Our team understood the problem, analyzed the data, and proposed a solution with a twist.

As the available data was huge, our team set up different data pipelines to ingest and transform the data into a format that was consumable by different ML models. Data Exploration and Preparation is a critical process of building ML models that needs a lot of focus & time to unearth useful data features.

After unearthing dozens of such features, these data features were then tested for their propensity to predict, using multiple experiments on different models and algorithms. Python and Spark on AWS were used for data processing and time series forecasting.

Finding the Future!

Within 2+ months, the team arrived at a few ML models to be able to predict a set of customers who could possibly leave in the next 2-3 months.

Initially, the model was validated using historical data for the customers, who had actually left. Once a good model performance was achieved we decided to try it out on live data for a quarter.

The model was exposed to live data, and it started predicting the customers who could potentially churn with reasonable accuracy.

Once the limited set of customers with the possibility to churn was identified, it was then handed over to company analysts. These analysts analyzed these customers in detail and made recommendation strategies for these customers like discounts, deals, specific dialogs with the customer on their pain points with commitments and actions for resolutions.

This was done for more than 4 months, and the results were observed. With feedback, loop implementation models were optimized further.

And the Results!

Within 4+ months, there was a visible drop in the percentage of churning customers. It was working really well !!

Further tuning of the models started yielding better results.

Today, the model is so effective that it reduced the churn by more than 25%, and provides more opportunities to up-sell and cross-sell within these customers.

With all that good predictions on your side, we are actually saving thousands of dollars for the client which would otherwise just flush away from their register. In the traditional sense ‘Money Saved Is Money Earned!’

Do you take actions to understand the challenges your customers might be facing and actively identify their intentions to stay with you or go away?

If not yet, at Coreview, we would like to have a look at it and help you to identify and retain your precious clients – to have more money in your drawers. 🙂

You can connect to me at sudhanwa.rajurkar@coreviewsystems.com for a quick call on how we can help you save your clients and money. So let’s have a chat?